-

Services

-

Practice Areas

- Banking and Finance

- Capital Markets

- Corporate M&A

- Dispute Resolution

- Employment and Labour

- EU and Competition Law

- Healthcare, Life Sciences & Pharmaceuticals

- Intellectual Property

- Projects and Energy

- Public Law

- Real Estate and Tourism

- Responsible Business

- Tax

- Technology, Media and Telecommunications

-

Sectors

- Agribusiness

- Banking and financial institutions

- Distribution and retail

- Energy and natural resources

- Government and public sector

- Healthcare, life sciences and pharmaceuticals

- Infrastructure

- Insurance and pension funds

- Manufacturing

- Mobility, transport and logistics

- Real estate and construction

- Social economy

- Sports

- Tourism and leisure

- Desks

- Buzz Legal

-

Practice Areas

-

People

-

Knowledge

-

Newsletter SubscriptionKeep up to date

Subscribe to PLMJ’s newsletters to receive the most up-to-date legal insights and our invitations to exclusive events.

-

-

About Us

-

Apply hereWe invest in talent

We are looking for people who aim to go further and face the future with confidence.

-

- ESG

-

Services

-

Practice Areas

- Banking and Finance

- Capital Markets

- Corporate M&A

- Dispute Resolution

- Employment and Labour

- EU and Competition Law

- Healthcare, Life Sciences & Pharmaceuticals

- Intellectual Property

- Projects and Energy

- Public Law

- Real Estate and Tourism

- Responsible Business

- Tax

- Technology, Media and Telecommunications

-

Sectors

- Agribusiness

- Banking and financial institutions

- Distribution and retail

- Energy and natural resources

- Government and public sector

- Healthcare, life sciences and pharmaceuticals

- Infrastructure

- Insurance and pension funds

- Manufacturing

- Mobility, transport and logistics

- Real estate and construction

- Social economy

- Sports

- Tourism and leisure

- Desks

- Buzz Legal

-

Practice Areas

-

People

-

Knowledge

-

Newsletter SubscriptionKeep up to date

Subscribe to PLMJ’s newsletters to receive the most up-to-date legal insights and our invitations to exclusive events.

-

-

About Us

-

Apply hereWe invest in talent

We are looking for people who aim to go further and face the future with confidence.

-

- ESG

Legal Insight

State Budget Law for 2023: Main tax measures

16/01/2023Law 24-D/2022 of 30 December was published to approve the State Budget Law for 2023 (‘SB2023’). It includes some changes to the Government’s draft law whose main topics we have already analysed (see here). Here, we will analyse the main amendments introduced by the Portuguese Parliament during the debate on the specific details of the budget and approved by the Parliament in the final overall vote.

PIT - Personal Income Tax

Capital gains made by non-residents

Capital gains resulting from the disposal of real rights over real estate and the transfer of contractual positions or rights inherent to real estate earned by non-residents will now be aggregated and taxed at the general PIT (Personal Income Tax) rates. These gains are only taxed on 50% of their value and provided they are not attributable to a permanent establishment located in Portugal.

Under the previous wording, this income was subject to an autonomous rate of 28% and did not expressly benefit from taxation at only 50% of its value. This created discrimination against resident taxpayers, which has already been recognised as illegal by the EU Court of Justice and resolved by case law. With this change, a system of equal treatment between residents and non-residents will come into force.

Deductions from taxable income

With the approval of the SB2023, the VAT (Value Added Tax) paid will be deductible from the PIT borne:

- when buying public transport tickets (not only passes);

- when buying subscriptions to periodical publications (newspapers and magazines), including digital publications, taxed at a reduced VAT rate.

Redemption of the value of PPRs without penalties

Until the end of 2023, the redemption without penalties of the value of the PPRs (retirement savings plans) to pay instalments of credit contracts secured by a mortgage on property, instalments of credit to build or improve property and payments to housing cooperatives will be allowed, even when the payments in question are less than 5 years old.

Law 19/2022 of 21 October also stipulates that, until the end of 2023, it will be possible to redeem PPRs without penalty and without restrictions as to the purpose of the redemption, up to the monthly limit of the SSI.

New rules on taxation of cryptoassets

The new rules on the taxation of cryptoassets were perhaps the one that underwent the most changes during the debate on the specific details of the draft budget 2023. These changes were made to bring the rules into line with the provisions of the EU Regulation on cryptoasset markets (MiCA).

In this context, the definition of cryptoassets initially proposed was approved and it was made clear that unique cryptoassets that are not fungible with other cryptoassets are not included in that concept. This means that NFTs (non-fungible tokens) are not subject to the new rules.

For ease of reference, here is a summary of the most important changes:

Category B income

In general terms, the proposed new taxation rules have been maintained, in particular, the simplified arrangements initially proposed (for both personal income tax and corporate income tax), although different coefficients are applied depending on the nature of the operation: (i) income relating to issuing cryptoassets is taxed at only 15%; and (ii) income from the mining of cryptoassets is taxed at 95%.

The purpose of this amendment is to penalise cryptoasset mining activities as they are considered to be environmentally unsustainable.

Category E income

The approval of SB2023 treats income derived from any other cryptoasset operations as capital income. Therefore, it is made clear that the remuneration derived from cryptoasset operations such as ‘staking’ is classified as category E income.

This income is exempt from withholding tax regardless of the form of payment, that is, even when paid in cash. When the income is paid in the form of cryptoassets, it is taxed under Category G (capital gains), but only upon the disposal of the cryptoassets received.

Category G income

Income arising from the disposal of cryptoassets for consideration outside the scope of a business or professional activity is taxed in accordance with the capital gains rules. Therefore, this income is subject to a tax rate of 28%, with the option of aggregation.

Gains and losses arising from the sale of cryptoassets which do not constitute securities held for at least 365 days will be excluded from taxation. The final version of SB2023 has the designation “exclusion” instead of “exemption” as initially proposed.

Additionally, in the context of the anti-abuse rules, it has been clarified that the income earned by taxpayers or due by any person/entity will not benefit from this exclusion from taxation when they are not tax resident (i) in another Member State of the EU or the EEA, or (ii) in another state or jurisdiction with which a double taxation treaty or a bilateral or multilateral agreement providing for the exchange of information for tax purposes is in force.

The loss of the Portuguese resident status is equated to a disposal for consideration and the taxable income is determined based on the positive difference between the market value at the date of loss of resident status and the acquisition value, plus any amounts necessary to the acquisition and actually paid. We believe this measure is likely to be questioned in terms of its compatibility with EU law.

SB2023 as approved in the debate on its specific provisions also clarifies that the FIFO (first in first out) rules applies to cryptoassets. Therefore, to calculate the balance of capital gains, the ones that were acquired the earliest will be considered to have been sold.

CIT - Corporate Income Tax

Tax loss carry forward rules

The limitation on the deduction of tax losses of 5 years remains in force regarding any losses assessed before 1 January 2023 if, by reference to the year of the tax loss, there was a simultaneous conversion of deferred tax assets into tax credit resulting from non-deduction of expenses and negative equity variations with impairment losses on receivables, and post-employment or long-term employee benefits. In other cases, the deductibility of losses has no time limit.

Taxation rules for groups of companies with their seat in an Autonomous Region

The SB2023 clarifies that for the group taxation rules to apply to companies with head office in an autonomous region, it is sufficient to subject them to the highest corporate income tax rate applicable in that region, instead of being subject to the highest normal rate under the general corporate income tax framework.

Deductibility of the costs of travel passes

With the approval of the SB2023, expenses incurred in buying travel passes for the benefit of staff will now be considered as social utility events. Therefore, they will be deductible from taxable profit at 150% of their value, instead of 130% as previously provided.

VAT - Value Added Tax

Increase in the exemption limit for self-employed workers

Taxpayers who (i) do not have organised accounts; (ii) do not engage in import, export or related activities; and (iii) do not engage in the transfer of goods and services in the waste, waste and recyclable scrap sector, and who do not have a turnover greater than €15,000 in the previous year, will now be exempt from VAT.

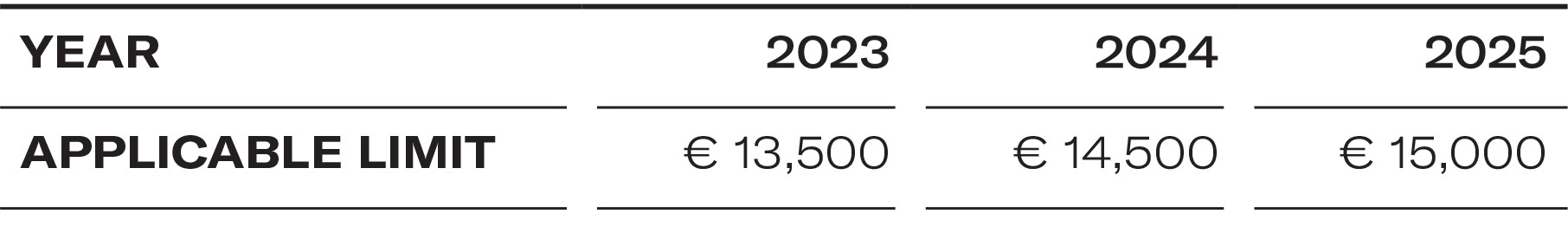

However, this limit will be progressively amended as follows:

Extension of the deadline to file the VAT return for the second quarter

The deadline for filing the June or second quarter VAT return is extended from 20 August to 20 September, and payment can be made until 25 September.

RETT – Real Estate Transfer Tax

Changes to the exemption rules on purchase for re-sale

Under the RETT (Real Estate Transfer Tax) Code, the acquisition of buildings for resale can benefit from a tax exemption when: (i) the acquirer is engaged in the activity of purchasing property for resale; and (ii) the property is resold within three years. This exemption is applicable automatically or by way of a refund.

With the approval of SB2023, the requirements for the automatic application of this REET exemption are now more demanding. Any taxpayer who normally and habitually engages in the activity of purchase for resale must prove that, in the previous two years, properties acquired for that purpose were resold in each of those two years. The previous rule referred only to the activity carried out in the previous year, the acquisition for resale no longer being relevant, and only the acquired property which is resold is taken into account.

Changes to the taxable value in property exchange transactions

If the property exchanged is transferred within one year of the date of the exchange, the rule that RET is levied only on the greater of the differences in value (difference in taxable value or difference in declared values) between the properties exchanged will no longer apply.

This alteration is an anti-abuse rule whereby the exchange is treated in general terms as a purchase and sale if the property exchanged is transferred within one year.

MPT - Municipal Property Tax

Exemption of classified properties

As from 2023, a municipal procedure for recognising the right to the MPT (Municipal Property Tax) exemption will be required in the case of properties of municipal interest. Furthermore, the municipalities must make this assessment, “when the classification is the responsibility of the municipalities or when the individual buildings are part of sets or sites classified as national monuments”.

Properties located in urban pressure zones

The municipalities can now increase the MPT rate applicable to real estate located in urban pressure zones, as defined in a specific law:

- up to 100% in cases where the property is used for tourist accommodation (alojamento local);

- up to 50% in cases where the property is for housing purposes but is not rented, when the taxpayer is a company or other legal entity with equivalent tax status;

- up to 25% in cases where the property is for housing purposes, but it is not rented as a dwelling or are used as the taxpayer’s own permanent residence.

Stamp Tax

Exemption in operations to restructure mortgage credit

In the context of loans set up under the legislation on housing credit (mortgages) and up to the amount of the outstanding principal, the following operations are exempt from Stamp Tax between 1 November 2022 and 31 December 2023:

- alteration of the loan term;

- extension of the loan term;

- entering into a new credit agreement to refinance the debt, with the guarantees provided also being covered;

- constitution of guarantees in the context of loans constituted under the legislation on housing credit up to the amount of the outstanding principal when they result in a change of credit institution or subrogation in the rights and guarantees of the mortgage creditor.

Tax incentives package

Incentive to capitalise companies

Of the several measures proposed in the tax incentive package provided for in the Draft State Budget Law for 2023, only the incentive to capitalise companies was amended during the vote on the specific details of the law.

SB2023 creates the Tax Incentive Scheme to Capitalise Companies (Regime Fiscal de Incentivo à Capitalização das Empresas - ’RFICE’) which replaces the Conventional Remuneration of Share Capital Scheme (Regime da Remuneração Convencional do Capital Social - ‘RCCS’), and the Deduction for Retained and Reinvested Profits Scheme (Regime de Dedução por Lucros Retidos e Reinvestidos - ‘DLRR’).

In this context, amendments were introduced to define the eligibility criteria to benefit from this new scheme.

Thus, for the purposes of deducting 4.5% of the amount of net increases in eligible equity capital from taxable profit, accounting profits of the tax period which are applied in retained earnings, or in reserves, or result in an increase in share capital are included.

As a result, the net value of the outflows, in cash or in kind, made to the shareholders as a result of the reduction of the share capital or the distribution of assets, as well as the distributions of reserves or retained earnings, are taken into account.

Accordingly, increases in eligible equity capital are now excluded when they result from:

- Contributions made in cash, as part of the incorporation of companies or the increase in the capital of the beneficiary company, which are financed by increases in eligible equity capital in another company.

- Contributions made in cash, in connection with the formation of a company or an increase in the capital of the beneficiary company by an entity with which the taxable person has a special relationship, which are financed by loans from the taxable person itself or by another entity with which it has a special relationship.

- Contributions in cash, as part of the incorporation of companies or a capital increase of the beneficiary company, by an entity that is not resident for tax purposes in another Member State of the European Union or the European Economic Area, or in another state or jurisdiction with which a double taxation treaty, bilateral or multilateral agreement providing for the exchange of information for tax purposes is in force.

Finally, to calculate the amount of net increases in eligible shareholders’ equity capital that occurred in the previous nine tax periods, only net increases that occurred in tax periods beginning on or after 1 January 2023 will be considered. As with the RCCS and the DLRR, this incentive does not contribute to the assessment result, and has also been included in the CIT (Corporate Income Tax) Code.

Income from rental to students

Income from property obtained under municipal student accommodation programmes that are subject to rental and sub-rental contracts for students living away from home, and which comply with the rent limits established, will now be exempt from Personal and Corporate Income Tax (PIT and CIT).

Summary of the main measures of the state budget

- The limits of exemption for PIT Youth Scheme are altered and there is an increase in the percentage of exemption to 50% in the first year, 40% in the second year, 30% in the third and fourth years and 20% in the final year.

- Residents and non-residents are treated equally for the purposes of taxation of real estate capital gains and 50% of the balance of real estate capital gains and losses obtained by non-residents are taxed. As a result, the autonomous rate of 28% will no longer apply.

- Until the end of 2023, it will be possible to obtain full or partial repayment of the value of PPRs (retirement savings plans) to pay mortgage loan instalments. Furthermore, the obligation to remain in the PPR for a minimum period of 5 years is removed.

- Taxation arrangements for cryptoassets have been created and income from cryptoassets will be classified as business income (Category B), capital income (Category E) or capital gains (Category G).

- The time limit for deduction of tax losses will be eliminated, and the quantitative limit for deduction of losses will be reduced to 65% (instead of 70%) of taxable profit.

- The need for prior authorisation from the Minister of Finance to use tax losses in the case of corporate reorganisations is eliminated, as is the deduction of the surplus of net financing costs not used in previous periods if the criterion of the existence of valid economic reasons is met.

- The scope of application of the reduced 17% IRC (Corporate Income Tax) rate is extended to taxable profits of up to €50,000 (instead of €25,000) and this rate will now also apply to small mid-cap companies.

- An incentive scheme is created for mergers of SMEs or small mid-caps carried out between 2023 and 2026. This scheme will allow the exceptional application of the reduced corporate income tax rate in the two financial years following the reorganisation if the companies lose their SME or small mid-cap nature due to that reorganisation.

- Vehicles powered exclusively by electricity with an acquisition cost of €62,500 or more will be taxed autonomously at the rate of 10%.

- Expenses and losses regarding electricity and natural gas can be increased by 20% for IRC purposes.

- Expenses of buying travel passes are deductible from taxable income at 150% of their value.

- A tax incentive is created that encourages improvements in workers’ salaries and the deductible expenses of salary increases are increased by 50%.

- The maximum VAT exemption limit for self-employed workers is gradually increased to €13,500 in 2023, €14,500 in 2024 and €15,000 as from 2025.

- To obtain an automatic MPT (Municipal Property Transfer) exemption on purchase for resale, the buyer must prove that in each of the two previous years that it has resold properties previously acquired for this purpose.

- The following will be exempt from Stamp Tax: (i) changes to and extensions of the terms of mortgage agreements, (ii) signing a new contract to refinance the debt, and (iii) the provision of new guarantees associated with these credits – provided certain requirements are met and provided that they are carried out between 1 November 2022 and 31 December 2023.

- The Tax Incentive Scheme to Capitalise Companies is created to replace the RCCS and DLRR. The new scheme will allow for a deduction from the taxable profit of companies of an amount corresponding to 4.5%, and 5% for companies classified as micro, small, medium or small-mid cap of the amount of the net increase in eligible equity capital.

- The existing sector-specific contributions remain in force: (i) banking sector contribution (CSB), (ii) additional solidarity banking sector contribution, (iii) extraordinary energy sector contribution, (iv) extraordinary pharmaceutical industry contribution, and (v) extraordinary contribution for the suppliers of medical devices industry of the National Health Service (SNS), and (vi) special contribution for the conservation of forestry resources.

Income from property obtained under municipal student accommodation programmes for rented and sub-rented accommodation for students living away from home, which comply with the established rent limits, are exempt from personal and corporate income tax (IRS and IRC).